Streamline Your Invoicing: How Xero Transforms the Process for Canadian Companies

At a Glance

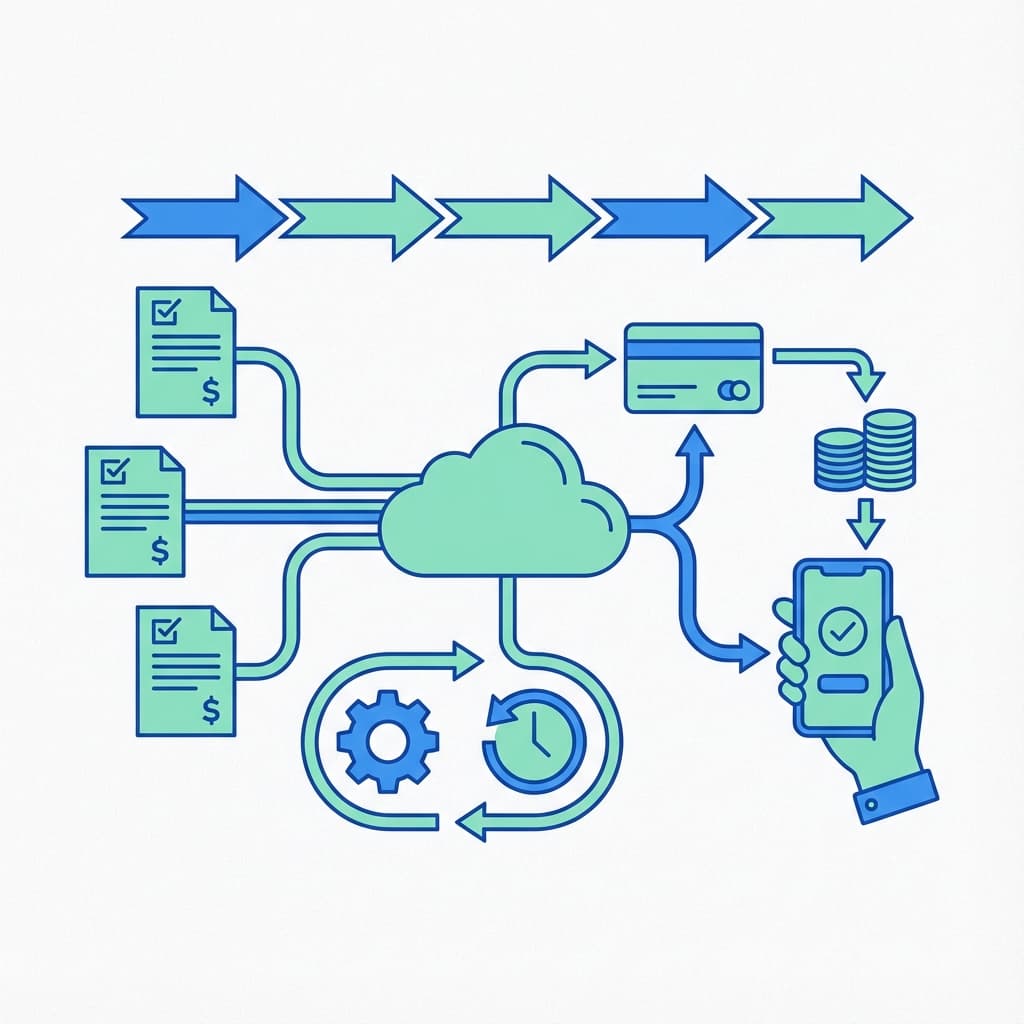

In an increasingly digital landscape, Canadian companies are seeking tools and technologies that optimize their financial functions, and the partnership between RBC and Xero is a major stepping stone in this journey. With the integration of Xero's robust invoicing system into RBC's payment platform, businesses are poised to experience a transformation in managing their finances. This collaboration simplifies the invoice-to-pay process significantly, offering Canadian businesses a seamless way to automate their supplier payments and reconciliations.

The adoption of Xero’s cloud-based accounting software by Canadian companies facilitates a more streamlined approach to invoicing and payment management. The convenience of importing authorized invoice details directly into RBC PayEdge and funding payments through various methods offers businesses a flexible, efficient, and secure way to settle their accounts. Moreover, automatic posting of transaction details saves precious time and reduces manual errors, bolstering the overall productivity and financial oversight.

Managing your business finances can be challenging, but finding the right tools can make all the difference. That's why we're excited to share an exclusive offer: 50% off Xero for 3 months with this Xero coupon code. This deal makes it easier than ever to simplify your accounting while saving money. Get 90% off Xero for 4 months

Get 6 Months of Xero at 90% Off

As Xero Partners, we have exclusive access to Canada's best software deal.

Key Takeaways

Overview of Xero for Canadian Businesses

Xero offers an online accounting software tailored for the requirements of Canadian small businesses. It is a solution that simplifies financial management by embracing automation and real-time accounting practices.

Key Features of Xero:

Pricing: Xero's plans begin at $20 per month, making it accessible for small businesses with varying budgets.

Benefits for Canadian Businesses:

Canadian businesses may find that Xero streamlines many of the tedious aspects of financial management, potentially reducing overhead and improving operational efficiency. Its user-friendly interface and comprehensive feature set position it as a competitive choice for those looking to manage their finances with greater ease and precision.

Setting Up Xero for Invoicing

Properly configuring Xero for invoicing is essential for Canadian companies looking to streamline their billing processes. This section covers the initial setup of Xero, the customization of invoice templates, and the integration of business details.

Basic Configuration

To begin using Xero for invoicing, a business must navigate to the settings tab and select Invoice Settings. Here, companies can manage the basic configuration which includes outlining default payment terms, setting up tax rates appropriate for their operations in Canada, and linking their bank account for effortless reconciliation.

Customizing Invoice Templates

Xero allows for the customization of invoice templates to fit the brand image and professional standards of a company. Businesses can create multiple templates, varying the design for different types of transactions. These templates can include essential elements such as:

Additionally, standard messages or notes to customers can be predefined in these templates.

Integrating Business Information

Efficiency in invoicing also comes from seamlessly integrating business information. With Xero, companies can:

Incorporating this information directly into Xero helps in avoiding data duplication and saving time on administrative tasks.

Managing Invoices with Xero

Xero streamlines the entire invoicing process for Canadian companies. Its features allow for quick invoice creation, efficient sending, and real-time tracking, ensuring a smooth cash flow management system.

Creating Invoices

With Xero, creating detailed invoices is made straightforward. Companies can input customer information, specify products or services, set prices, and choose tax settings. Xero's automation features include:

Sending Invoices

Once an invoice is created, sending it to clients is just a few clicks away. Users can:

Additionally, partial payment options provide flexibility to clients, enhancing customer relations.

Tracking Invoice Status

Xero offers real-time tracking of every invoice's status. Companies receive instant updates, which facilitates:

With these tools, businesses can maintain accurate records of their financial transactions with ease.

Streamlining Processes with Xero Features

Xero introduces several features designed to enhance the efficiency of invoicing processes for Canadian companies. These tools not only save time but also minimize the risk of errors and facilitate faster payments.

Automated Reminders

Xero's automated reminders can be configured to notify clients about upcoming or overdue payments. This function alleviates the administrative burden of following up on unpaid invoices, ensuring that both the business and the clients are aware of all payment obligations.

Recurring Invoices

For clients with repeat services, Xero's recurring invoices feature automates the billing cycle.

Online Payment Options

By integrating with multiple online payment options, Xero provides convenience to both the company and its clients.

By employing these features, Xero supports Canadian companies in maintaining timely and efficient invoicing procedures.

Reporting and Reconciliation in Xero

Xero offers a comprehensive suite of reporting and reconciliation tools designed to provide accurate financial insights and streamline the accounting processes for Canadian companies. These tools assist businesses in keeping up with the crucial tasks of financial reporting, transaction reconciliation, and GST/HST management.

Financial Reporting

In Xero, financial reports are readily available and customizable to suit a company's needs. Balance sheets, profit and loss statements, and cash flow reports can be generated with a few clicks, enabling businesses to monitor their financial health in real-time. Xero's reporting capabilities also extend to tracking expenses and monitoring project performance, providing a layered view of financial data.

Reconciliation Tools

The reconciliation tools in Xero automate much of the manual work typically associated with matching transactions. Companies can reconcile bank transactions daily, ensuring their financial records align with bank statements. Xero suggests matches for transactions, shown in green, significantly reducing the time it takes to reconcile. Additionally, bank rules can be created to facilitate recurring matches, further enhancing efficiency.

GST/HST Management

For Canadian businesses, managing GST/HST is a critical component of accounting. Xero simplifies this process by allowing for easy tracking and reporting of GST/HST. Transactions within Xero can be tagged with relevant tax rates, and the software can generate comprehensive GST/HST reports that breakdown the amounts collected and owed, streamlining the preparation for tax filings.

Enhancing Productivity

Invoicing efficiency is paramount for Canadian companies. Xero's accounting software offers powerful tools to expedite this essential financial process.

Batch Invoicing

Xero facilitates batch invoicing, enabling users to create and send multiple invoices simultaneously. This means companies save time by not having to generate individual invoices for each customer. Specifically, they can:

Mobile Invoicing

Xero's mobile invoicing capability allows for the creation and management of invoices on-the-go. Users can:

Add-on Integrations

The software's add-on integrations with over 1,000 third-party business apps provide further productivity enhancement. They allow businesses to:

By utilizing these functionalities, Canadian companies can streamline their invoicing process, saving time and resources which can be redirected towards other business growth activities.

Security and Compliance

When utilizing Xero for invoicing, companies benefit from robust security measures and adherence to Canadian regulations. This ensures both the protection of financial data and compliance with relevant standards.

Data Security Measures

Xero employs comprehensive security protocols to safeguard data. These measures include:

Compliance with Canadian Regulations

Xero's platform aligns with Canadian business requirements, ensuring that companies remain compliant:

Customer Support and Resources

Effective customer support and resource availability are critical for Canadian companies using Xero to streamline their invoicing processes. Xero provides robust support options and comprehensive learning materials to help users make the most of its invoicing features.

Xero Support Channels

Xero offers multiple channels for support to ensure users have access to timely assistance. Users can contact Xero's customer support team through:

Additionally, Xero has a comprehensive Help Center with articles and guides, helping users resolve common problems or learn more about specific features.

Learning and Development

Xero invests in the education of its users through a variety of learning resources:

These resources empower users to maximize their proficiency in using Xero for invoicing, ultimately leading to improved business workflows.

Frequently Asked Questions

The following FAQs provide clear insights on how Xero streamlines invoicing for Canadian companies, addressing setup, sales tax calculation, system integration, customization options, automation benefits, and support resources.

What steps are involved in setting up Xero for invoicing in Canada?

To set up Xero for invoicing, Canadian businesses begin by creating an account, configuring company settings for the Canadian market, including currency, and importing customer data. The next step involves integrating bank accounts and setting up the chart of accounts aligned with Canadian accounting standards.

How does Xero handle sales tax calculations for Canadian businesses?

Xero is equipped to automatically calculate the appropriate sales tax for invoices, which in Canada includes GST, HST, PST, or QST, depending on the province. Users can set default tax rates for their products and services, ensuring accurate and compliant invoicing.

Can Xero integrate with other Canadian financial systems for streamlined invoicing?

Yes, Xero offers robust integration capabilities and can sync with several Canadian financial systems, such as payroll services, payment processing tools, and CRM software, allowing for a streamlined flow of data across business operations.

What customization options are available for invoices in Xero?

Xero provides multiple invoice templates that Canadian businesses can customize with their logos, payment terms, and brand colors. Users can also create bespoke templates suited to their company’s needs or clients' preferences.

How does Xero's invoicing automation benefit Canadian companies?

Xero’s invoicing automation allows Canadian businesses to schedule recurring invoices, send automatic payment reminders, and reconcile invoice payments with bank transactions. This automation saves time and reduces the likelihood of human error, improving overall efficiency.

What support and resources does Xero offer to Canadian companies for invoice management?

Xero offers a range of support resources including online guides, instructional videos, and dedicated customer support. Canadian companies can also access Xero’s extensive online community and training programs to enhance their proficiency in invoice management and other financial operations.

Seb Prost, CPACPA, Ex-CRA

Seb is the founder of LedgerLogic and a CPA dedicated to simplifying finances for Canadian entrepreneurs. He specializes in setting up automated accounting stacks for e-commerce and agency owners.